Want to buy a home but worried about getting approved for a mortgage? Here’s the good news: With the right preparation, you can boost your chances of approval and secure better terms. This guide covers essential steps to get mortgage-ready, focusing on your credit score, savings, and avoiding common mistakes.

Key Takeaways:

- Credit Matters: Payment history makes up 35% of your credit score. Aim for a score above 620 for most loans, but higher scores get better rates.

- Save Smart: You’ll need cash for a down payment (3%-20% of the home price) and closing costs (2%-5% of the loan amount). Build an emergency fund too.

- Avoid Pitfalls: Don’t make big purchases, apply for new credit, or change jobs during the mortgage process.

Quick Mortgage Prep Checklist:

- Review and improve your credit score (on-time payments, low credit utilization).

- Save for a down payment and closing costs using a dedicated savings account.

- Avoid financial changes like new debt or job switches before closing.

By following these steps, you’ll be ready to approach lenders with confidence and make your dream of homeownership a reality.

10 Ways to DESTROY Your Chances of Getting a Home Loan

Building a Strong Credit Profile

Your credit score plays a central role in your mortgage application. It not only determines your approval odds but also directly impacts the interest rate you’ll receive. With the average credit score in 2024 reaching 717 [5], understanding your score – and knowing how to improve it – can give you a competitive edge in the mortgage process.

Credit Score Requirements for Different Loan Types

Each mortgage program comes with its own credit score thresholds. Here’s a quick look at the typical minimums:

| Loan Type | Minimum Credit Score |

|---|---|

| Conventional loan | 620 |

| Jumbo loan | 700 |

| FHA loan | 500 |

| VA loan | 620 (lender-dependent) |

| USDA loan | 580 |

While these are the minimum requirements, most borrowers exceed them. For instance, in 2024, the average credit score for conventional borrowers was 755, while FHA borrowers averaged 692 [5]. This highlights that meeting the minimum doesn’t necessarily secure the best terms. Lenders often reserve the most attractive interest rates for applicants with higher scores.

Government-backed options, like FHA loans, provide more leniency for those with lower scores but often come with additional costs, such as mortgage insurance premiums [5]. Conventional loans, on the other hand, may require higher credit scores but can offer better terms if you qualify [6]. If your score is on the lower side, a larger down payment can sometimes help balance the equation [4].

How to Improve Your Credit Score

If your credit score needs a boost, the good news is that improvements are possible – and often faster than you might think. Since payment history accounts for 35% of your FICO score and amounts owed make up 30% [9], focusing on these areas can yield noticeable results.

Start by ensuring consistent, on-time payments. Automating payments or setting reminders can help you avoid missed due dates, which can significantly hurt your score.

"The most effective way to improve your credit score is to pay down your revolving debt." – Daryn Gardner, Jax Federal Credit Union [8]

Keep your credit utilization rate below 30%. Paying down balances and avoiding unnecessary charges can make a big difference.

"Only charge as much as you can reasonably pay off within a given month." – Steven Millstein, Credit Zeal [8]

Check your credit reports regularly at AnnualCreditReport.com. If you spot errors, dispute them promptly. Rapid rescore services can help correct inaccuracies more quickly [8].

Another option is becoming an authorized user on a family member’s credit card. If they have a solid payment history, this can positively influence your score without requiring you to open new accounts [7]. However, while preparing for a mortgage, avoid applying for new credit entirely. Each application leads to a hard inquiry, which can temporarily lower your score [8].

Protecting Your Credit During the Mortgage Process

Once you’ve started the mortgage process, safeguarding your credit profile becomes even more critical. Lenders may pull your credit again before closing, and any negative changes could affect your approval or interest rate.

Here’s how to keep your credit stable during this time:

- Make all payments on time. This includes credit cards, auto loans, and student loans [10]. Automating payments can help you stay consistent.

- Delay major purchases. Large expenses can increase your debt-to-income ratio, raising red flags for lenders [10].

- Avoid new credit applications. Even if you’re pre-approved, applying for additional credit can alter your financial profile and jeopardize final approval [10].

- Maintain job stability. If you’re considering a job change, discuss it with your loan officer first, as lenders verify employment and income throughout the process [10].

- Avoid large cash deposits. These may require extra documentation, which can delay or complicate the process. Keep your loan officer informed about any financial changes [10].

Your credit profile is more than just a number – it’s a reflection of your financial reliability. By understanding credit requirements, improving your score, and protecting it during the mortgage process, you’ll position yourself for approval and better loan terms. With your credit in good shape, you can shift your focus to building the cash reserves needed for your home purchase.

Saving Money for Your Home Purchase

Once you’ve strengthened your credit profile, the next step in preparing to buy a home is building up the cash reserves you’ll need. Beyond the down payment, you’ll also need to plan for closing costs and set aside required reserves. Knowing exactly how much to save can make the process feel more manageable.

Down Payment Requirements and Savings Tips

A common misconception is that you need a 20% down payment to buy a home. In reality, first-time buyers often put down much less. In 2024, the median down payment for first-time homebuyers was just 9%, while the overall average was 18% [11]. For context, the typical down payment in December 2024 was $63,188, or 16.3% of the home’s purchase price [13].

Different loan programs offer varying minimum down payment requirements, giving you flexibility depending on your financial situation:

| Home Loan Type | Minimum Down Payment |

|---|---|

| VA loan | 0% |

| USDA loan | 0% |

| FHA loan | 3.5% |

| Conventional loan | 3% |

To put these percentages into perspective, here’s what different down payments look like for various home prices:

| Home Purchase Price | 3% Down Payment | 10% Down Payment | 20% Down Payment |

|---|---|---|---|

| $200,000 | $6,000 | $20,000 | $40,000 |

| $400,000 | $12,000 | $40,000 | $80,000 |

| $600,000 | $18,000 | $60,000 | $120,000 |

For qualified buyers, VA and USDA loans require no down payment at all [11]. While putting 20% down on a conventional loan can eliminate private mortgage insurance (PMI), a smaller down payment isn’t necessarily a bad idea. It allows you to buy a home sooner and start building equity rather than waiting years to save more [12]. That said, a larger down payment does reduce your monthly payments and could secure a better interest rate, so it’s worth balancing this against your timeline and other financial priorities [12].

To save for your down payment more effectively, consider automating transfers into a dedicated savings account. Treat it like a mandatory bill. Cutting back on non-essential spending or taking on extra work can also accelerate your savings. Once your down payment goal is in sight, don’t forget to account for closing costs and establish an emergency fund to ensure you’re fully prepared.

Closing Costs and Emergency Fund Planning

In addition to the down payment, closing costs are another expense you’ll need to plan for. These costs often catch buyers off guard, but they’re unavoidable. Typically, closing costs range from 2% to 6% of your loan amount [14]. For a $300,000 loan, this means setting aside $6,000 to $18,000 [14]. In 2021, the national average for closing costs, including transfer taxes, was $6,905 – or $3,860 without transfer taxes [18].

"Closing costs include the myriad fees for the services and expenses required to finalize a mortgage. You’ll pay closing costs whether you buy a home or refinance." – NerdWallet [14]

Here’s a quick look at some common closing cost components:

- Loan origination charges: About 1% of the loan amount [14]

- Appraisal fee: $500–$800 [14]

- Title insurance: Approximately 0.5% to 1% of the home’s price [14]

- Survey fee: $400–$1,000 [15]

- Attorney fees: Varies by state and local rates [15]

- Government recording fees: Around $125 [14]

- Credit reporting fees: $10–$100 [15]

Closing costs can vary significantly based on location. For example, in 2021, Washington D.C. had the highest average closing costs at 3.9% of the sales price, while Missouri had the lowest at 0.8% [18]. To reduce these costs, shop around with multiple lenders since fees can differ greatly [17]. Negotiating with sellers or scheduling your closing near the end of the month can also help cut down on some expenses [14][16].

Once you’ve accounted for your closing costs, shift your focus to building an emergency fund. Unlike renting, owning a home means you’re responsible for repairs and maintenance. On average, homeowners spend $9,390 annually on home-related expenses, and nearly half face an unexpected repair within their first year [19]. Experts recommend budgeting 1% to 2% of your home’s purchase price annually for upkeep – or about $1 per square foot [19]. Major repairs can be costly: a new roof averages $7,600, central air replacement runs $1,500 to $4,000, and water heater replacements fall between $762 and $1,426 [19].

To protect yourself financially, aim to save three to six months’ worth of living expenses in a high-yield savings account. Keep this fund separate from your down payment and closing cost savings [21]. This safety net ensures you can cover unexpected repairs or maintain mortgage payments during emergencies, like a job loss, without resorting to high-interest debt [20].

sbb-itb-8115fc4

Common Mortgage Application Mistakes to Avoid

Even with strong credit and healthy savings, small errors can derail your mortgage application. Being aware of common pitfalls can help you steer clear of unnecessary delays or even denials.

Credit Mistakes That Can Hurt Your Application

Your credit habits during the mortgage process are just as important as your credit history. Many buyers unintentionally weaken their applications by mishandling their credit at a crucial time.

One key mistake is making large purchases, like buying a car or expensive furniture, before your loan closes. These purchases can throw off your debt-to-income ratio, which lenders closely monitor. Even if you’re pre-approved, lenders recheck your finances before closing, and new debt could lead to a rejected application [22].

Another common misstep is failing to check your credit report well in advance. Reviewing it at least six months before applying gives you time to spot and correct any errors. A 2013 FTC study revealed that "one in four consumers identified errors on their credit reports that might affect their credit scores" [23]. This is especially important considering that between 2009 and 2013, tightened credit standards resulted in 4 million denied home purchase loans [23].

Beyond your credit, your employment situation can also make or break your application.

Employment and Income Changes That Can Hurt Your Application

Lenders rely on employment stability to feel confident in your ability to repay a loan over decades [26]. If you change jobs during the application process, it can lead to delays or even derail your approval [28]. Most lenders prefer to see at least two years of consistent work history in the same field [27].

Switching to commission-based or variable income can also complicate matters. Salaried positions are seen as more reliable because they provide steady paychecks. On the other hand, hourly, commission-based, or contract work introduces uncertainty, which can make lenders hesitant. They typically prefer borrowers to maintain a debt-to-income ratio below 43% [27][29].

Failing to notify your lender about changes in your income or job can be especially problematic. A change in employment or pay structure directly impacts your ability to repay the loan and must be disclosed [1].

"When a lender hands over hundreds of thousands of dollars, they need to be supremely confident that you can pay off the mortgage over the next 20–30 years." – Alan Hartstein, Writer [26]

If you’re anticipating a job change, inform your loan officer immediately [22]. Be proactive – provide documentation like offer letters, pay stubs, and W-2 forms to support your application. If possible, finalize your mortgage before making any career moves [29].

While credit and employment are critical, your financial behavior can also impact your mortgage approval.

Money Management Errors

Financial mistakes during the mortgage process can be just as damaging as credit or employment issues. Lenders carefully review your bank statements and financial activity for anything that might raise concerns.

One common error is failing to document large deposits. Lenders need to verify that these funds aren’t borrowed. Be prepared to provide bank statements, gift letters, or other proof of origin for any significant deposits [1].

Another mistake is unnecessarily moving money between accounts, which can create extra paperwork and confusion [24]. Additionally, buyers who start spending on new furniture or home improvements before closing may reduce the cash they need for closing costs, potentially jeopardizing their loan.

Missing payments during the application process is another red flag. Since payment history accounts for 35% of your FICO credit score, even one late payment can hurt your approval chances or lead to a higher interest rate [25]. Co-signing loans for others can also increase your debt obligations, negatively affecting your debt-to-income ratio [24].

To avoid these issues, maintain financial stability from the time you apply until your loan closes. Hold off on major purchases, keep detailed records of your financial transactions, and be ready to explain any unusual activity to your lender [22]. Staying organized and disciplined can make all the difference.

Your Step-by-Step Mortgage Preparation Plan

Getting ready for a mortgage isn’t something you can do overnight. It requires a clear timeline and actionable steps. Let’s break it down into manageable parts, focusing on credit, cash, and avoiding common pitfalls.

Key Points About Credit, Cash, and Common Mistakes

Here’s a quick recap of the main themes we’ve covered so far:

- Credit Profile:

Pay your bills on time and aim to keep credit card balances low. Remember, your payment history makes up 35% of your FICO score [34]. Check your credit report at least six months before applying for a mortgage to fix any errors [22]. - Cash Preparation:

Be prepared for closing costs, which usually range from 2% to 5% of the home’s purchase price [2]. Build an emergency fund and budget for ongoing expenses like property taxes, insurance, and maintenance. - Avoiding Common Mistakes:

Don’t make big purchases or open new credit lines after getting pre-approved [34]. Keep your job stable and aim for a debt-to-income ratio below 43% (some lenders prefer under 36%) [2]. As financial expert Jeff Avevelo advises:

"It’s good practice not to rock the boat for six months or even a year leading up to a mortgage application" [3].

Building Your Personal Timeline

Your timeline will depend on your current financial situation, but here’s a general guide:

- Short-Term (1–3 months):

Get pre-approved for a mortgage. Pre-approvals typically last for 120 days [31]. The home-buying process itself usually takes about four months [2]. Once your offer is accepted, expect 30 to 60 days to close, with underwriting taking a few days to a couple of weeks [31][32]. - Mid-Term (3–12 months):

Start by reviewing your finances. Create a budget to track spending, debts, and savings [30]. Automate your bill payments to build a solid payment history [34]. Focus on saving for your down payment and closing costs. - Long-Term (6–12 months):

Resolve any credit issues, as corrections can take up to six months. Mandy Kelso of TD Bank suggests:

"Make sure you get anything off of your credit report that is incorrect. It’s worth the time you invest to fix errors on your credit report" [30].

Use mortgage calculators to estimate monthly payments and get a real sense of homeownership costs [2]. Reach out to a financial professional early if you need help addressing credit challenges or meeting qualification requirements [33].

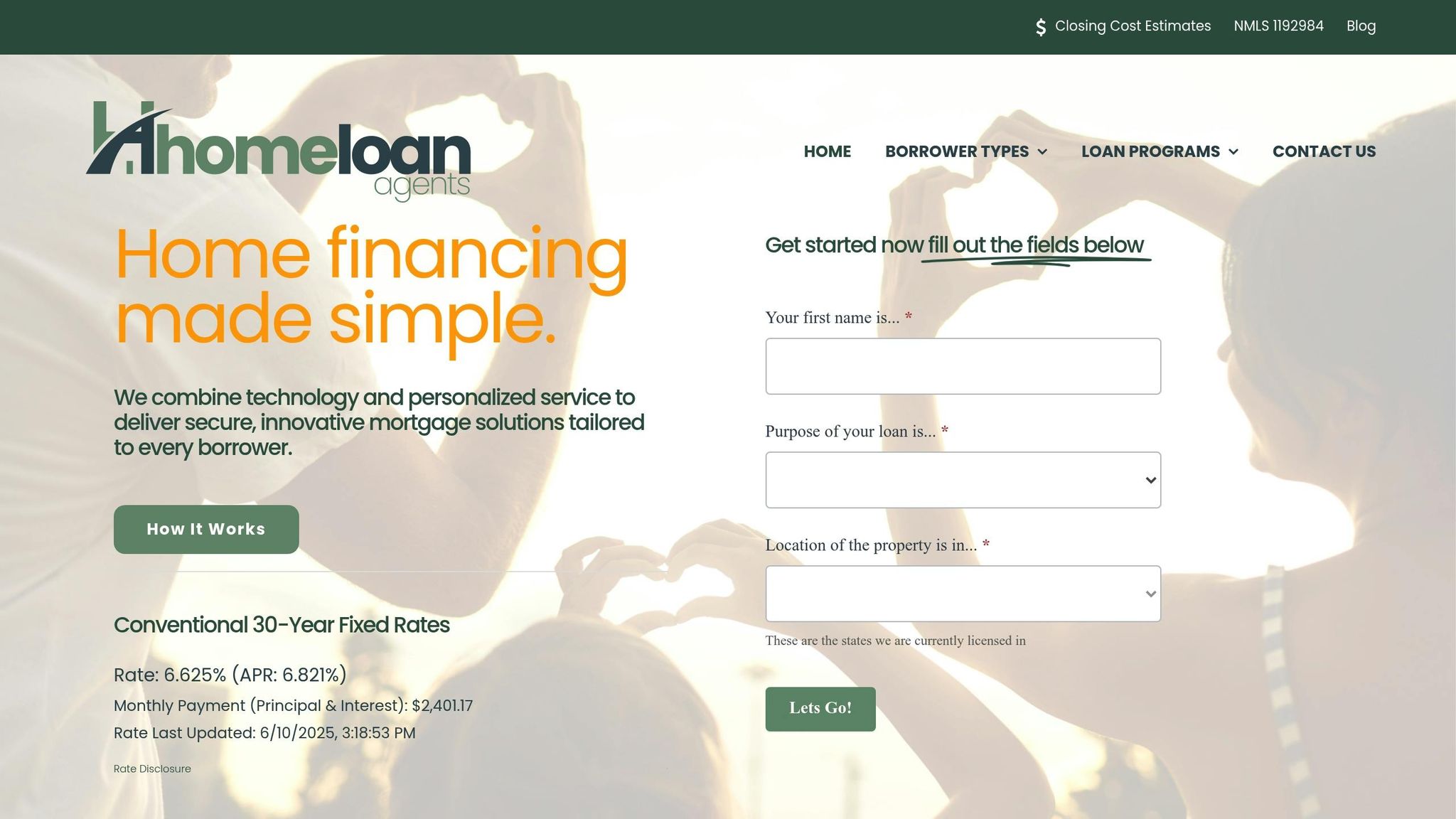

Why Choose HomeLoanAgents for Your Mortgage

Once you’ve laid the groundwork, having the right support can make all the difference. HomeLoanAgents offers a variety of loan options and digital tools to simplify the process [35]. With just one application, they connect you to multiple lenders, saving you time and effort [35].

Their services include AI-driven underwriting, digital income and asset verification, and eClosings, making the process almost entirely paperless. Plus, real-time updates keep you informed every step of the way. Whether you’re dealing with credit issues or unique income situations, their team provides personalized guidance to help you close with confidence [35]. HomeLoanAgents is licensed in CA, AZ, NV, WA, OR, CO, TX, FL, WI, and ID, ensuring compliance with all state and federal regulations.

Vanessa Owens of TD Bank offers this encouragement:

"I tell anyone, if you’re looking to purchase a home, reach out and start that journey now. If you’re not ready now, let’s see what you need to do to become ready. Don’t get discouraged, there are a lot of resources out there that can help someone purchase a home" [30].

With HomeLoanAgents by your side, you’ll have the tools and expertise to make your homeownership dream a reality.

FAQs

How can I quickly improve my credit score before applying for a mortgage?

To get your credit score in better shape before applying for a mortgage, start by checking your credit reports from the three major bureaus: Equifax, Experian, and TransUnion. Look for any errors or inaccuracies and dispute them right away – they could be dragging your score down unnecessarily.

Make sure you’re paying all your bills on time, as your payment history has a big impact on your credit score. Setting up automatic payments can help you stay on track and avoid missed due dates. Another key move? Lower your credit card balances to keep your credit utilization ratio under 30%. This shows lenders you’re managing your credit responsibly.

It’s also a good idea to hold off on opening any new credit accounts, as this can temporarily lower your score. If you have a trusted family member or friend with a strong credit history, ask if they’d be willing to add you as an authorized user on their credit card. This can let you benefit from their solid payment record.

By sticking to these strategies, you can strengthen your credit profile and improve your chances of landing a mortgage with a better rate.

What’s the best way to save for a down payment, closing costs, and an emergency fund at the same time?

To save for a down payment, closing costs, and an emergency fund all at once, it’s important to start with specific, achievable goals. For the down payment, plan to save between 3% and 20% of the home’s price. Closing costs typically range from 2% to 6% of the loan amount. Meanwhile, an emergency fund should cover at least three to six months of your living expenses.

Build a budget that puts savings first by designating a portion of your income for these priorities. Automating your savings can simplify the process and help you stay consistent. If you need to save more, look for ways to cut back on nonessential spending or think about picking up a side hustle. By juggling these strategies, you can prepare for homeownership while keeping a financial cushion for any surprises.

What financial mistakes should I avoid to ensure my mortgage application gets approved?

To boost your chances of getting your mortgage approved, steer clear of these common financial missteps:

- Making large purchases before closing: Big-ticket buys like a car or furniture can throw off your debt-to-income ratio, putting your approval at risk. Hold off on major spending until after you’ve closed on your home.

- Skipping an early credit check: Check your credit score at least six months before applying. This gives you time to fix errors or work on improving your score if necessary.

- Switching jobs mid-process: Lenders prioritize income stability. Changing jobs while your mortgage application is in progress can raise concerns and potentially delay or derail your approval.

By avoiding these mistakes, you’ll be better positioned to navigate the mortgage process smoothly and get closer to owning your dream home.

Related posts