What is an LTV?

Loan to Value, also known as LTV, is the calculation of how much equity you have in your home. LTV is calculated by taking your loan amount and divide it by the lesser of your appraised value or the purchase price of your property. The higher the LTV, the less equity you have, which makes the loan more risky and higher risk always equates to higher rates. Combined Loan to Value (CLTV) is when you have additional liens on the property. CLTV is calculated by adding all the mortgage lien balances together and divide it by the lesser of your appraised value or the purchase price. If there are no other liens, then the CLTV is the same as the LTV.

Types of Verification

Every loan requires that we verify the information that you provide. There are 3 ways to verify:

- Manual Verification – this is the most traditional way where we ask for statements, usually in PDF format, from your account holder. This is less secure but has been the norm for many years. Remember to always send all pages of your account statements to your loan agent.

- Digital Verification – this is the latest in technology where a 3rd party accesses on the pertinent pieces of information directly from your account holders and shares that information with us. This is universally accepted by FannieMae and FreddieMac and is actually more secure than the manual verification method and can speed up your loan process. The 3rd parties we work with are the industry standard and are FormFree, Finicity, and Equifax.

- No Verification – there is another option where you don’t want to verify your account at all. There are programs for this which is why we include this as an option.

Why we need email

We need your email address so that we can communicate with you regarding your prequalification or your loan application. We are not in the business of spamming people, we are in the loan business. If you don’t want to hear from us, then just tell us and we will remove you from any and all communication.

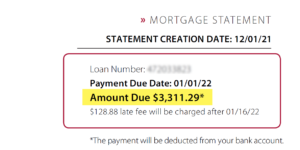

Where can I find my current mortgage balance?

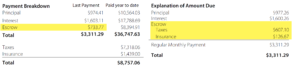

Your current mortgage balance can be found in the most current mortgage statement from your service (the company you make mortgage payments to). Make note if this payment includes taxes & insurance, which could be labeled on your statement as Escrow and is in addition to Principal and Interest.

sample mortgage payment screenshot

sample escrow/impound payment indication