Want to buy a home? Here’s the deal: Pre-approval gives you a verified commitment from a lender, while pre-qualification is just an estimate of what you might afford. Sellers overwhelmingly prefer pre-approved buyers – 85% of sellers favor offers with pre-approval.

Key Differences:

- Pre-Qualification: Quick, no paperwork, based on self-reported data. Good for early budgeting but less reliable.

- Pre-Approval: Requires documents, includes a credit check, and gives you a stronger position with sellers.

Quick Comparison:

| Feature | Pre-Qualification | Pre-Approval |

|---|---|---|

| Application | Not required | Required |

| Credit Check | Soft inquiry (sometimes) | Hard inquiry |

| Financial Data | Self-reported | Verified with documents |

| Loan Amount | Estimate | Confirmed |

| Seller Perception | Less competitive | Highly competitive |

Bottom Line: If you’re serious about buying a home, pre-approval is your best bet. It boosts your credibility, speeds up the process, and gives you confidence to make strong offers.

Preapproved vs Prequalified for a Mortgage. What is better? @newwaymortgage

What Is Pre-Qualification: The Basics

Pre-qualification gives you a rough idea of how much you might be able to borrow based on basic financial details you share with a lender. Think of it as a first step – a quick way to get a general estimate before diving into serious house hunting.

The process is simple and fast. You can do it online, over the phone, or in person, and often get results in minutes. For instance, Bank of America offers an online pre-qualification tool that can provide results in under an hour [3]. This speed makes it appealing for buyers who want a quick snapshot of their purchasing power without dealing with a pile of paperwork.

"Prequalification is an early step in your homebuying journey… an estimate of what you might be able to borrow, based on information you provide about your finances, as well as a credit check." – Bank of America [3]

How Pre-Qualification Works

The process is straightforward and relies on information you provide about your finances. You’ll typically share details like your income, monthly debts, assets, and the amount you plan to use as a down payment. In some cases, the lender might perform a soft credit check, but this isn’t always required [2].

Unlike pre-approval, pre-qualification doesn’t require you to submit supporting documents like pay stubs, bank statements, or tax returns [5]. Instead, the lender takes your word for it and calculates an estimate of how much you could potentially borrow.

A survey by Zillow found that about 27% of prospective buyers who haven’t yet partnered with an agent have already gone through pre-qualification [4]. This step can help you get a clearer picture of your financial position before moving forward.

What Buyers Get from Pre-Qualification

Once you complete pre-qualification, you’ll receive an estimated loan amount. This number helps you set a realistic budget for your home search and gives you an idea of your borrowing potential. However, it’s crucial to remember that this is just an estimate – it doesn’t guarantee loan approval [2].

The pre-qualification letter you receive isn’t as strong as a pre-approval letter in the eyes of sellers because it’s based on unverified information. This can make it less competitive, especially in a fast-moving market.

Pre-qualification also acts as a financial checkpoint. If the estimated loan amount doesn’t meet your expectations, it may highlight areas where you need to improve – like boosting your credit score, paying down debts, or saving more for a down payment. These insights can help you prepare for the next steps in your homebuying journey.

Pre-Qualification Pros and Cons

Pre-qualification has some clear advantages. It’s quick and convenient, making it a great option for first-time buyers who want to understand their budget without gathering a ton of paperwork. It also helps you spot potential financial challenges early, giving you time to address them before moving forward [3][2].

That said, there are downsides. Since pre-qualification relies on self-reported information and doesn’t involve document verification, the accuracy of the estimate can vary. This means the amount you’re pre-qualified for might not match what you’ll actually qualify for when your finances are thoroughly reviewed.

Another limitation is that pre-qualification letters don’t carry much weight with sellers. In competitive markets, this can put you at a disadvantage compared to buyers who already have pre-approval, which involves a more detailed financial review.

| PRE-QUALIFICATION | PRE-APPROVAL |

|---|---|

| Benefits: Gives you a rough idea of how much you might borrow | Benefits: Makes you a stronger buyer, ready to confidently make offers |

| Process: Share basic financial details and get an estimate quickly | Process: Submit detailed financial documents and receive a decision in about 10 business days |

| Documentation: Minimal – just answer questions and possibly a credit check | Documentation: Requires proof of income, assets, and other financial details, plus a credit check |

This comparison shows that pre-qualification is best suited for the early stages of your homebuying journey. It’s a great starting point when you’re exploring your options and want a general idea of what’s affordable. However, it’s not designed to give you the competitive edge needed later in the process. Understanding its benefits and limitations can help you decide how pre-qualification fits into your overall strategy.

What Is Pre-Approval: A Verified Commitment

Pre-approval takes the concept of pre-qualification a step further by verifying your financial information through actual documentation. This detailed process not only confirms your financial stability but also reassures sellers that you’re a serious buyer with solid financing in place.

The main distinction between the two lies in the level of verification. While pre-qualification relies on your self-reported income and assets, pre-approval demands proof through official documents. As a result, the loan amount you’re approved for is far more precise and dependable than a simple estimate.

Let’s dive into how pre-approval works and why it’s so crucial for homebuyers.

How Pre-Approval Works

To get pre-approved, you’ll need to complete a formal mortgage application and provide detailed financial documents. These typically include recent pay stubs, W-2 forms from the last two years, bank statements, tax returns, and details about your monthly debts and assets. After submitting your application, the lender conducts a hard credit inquiry and thoroughly evaluates your financial profile. This process can take up to 10 business days to complete [3].

Kevin Leibowitz, president and CEO of Grayton Mortgage, explains the process:

"A pre-approval is what I call ‘show me.’ What I mean by that is let me see the real documents that I – or underwriting – will need for an approval: pay stubs, W-2s, bank statements, credit report, tax returns, etc. We’re not completely underwriting the file, but it is a thorough review of a borrower’s profile."

During this review, the lender verifies your employment, calculates your debt-to-income ratio, and ensures you can comfortably handle monthly mortgage payments. If everything checks out, you’ll receive a pre-approval letter stating your exact loan amount and interest rate. This letter is typically valid for 60–90 days, giving you a clear timeframe to shop for a home within your approved budget [2].

This letter not only confirms your financial capacity but also strengthens your position as a buyer, making it a valuable tool in negotiations.

The Pre-Approval Letter: A Key Negotiation Tool

In competitive housing markets, a pre-approval letter can set you apart from other buyers. It demonstrates to sellers that you’re not just browsing – you’re a serious, financially verified buyer. Sellers often face risks when accepting offers from buyers who haven’t secured financing, and a pre-approval letter helps reduce that uncertainty by showing that a lender has already assessed your creditworthiness.

This credibility can make all the difference when competing against other buyers. Phil Crescenzo Jr., Southeast division president of Nation One Mortgage Corporation, highlights this advantage:

"A pre-approved buyer is more likely to win an offer over a less prepared buyer or realtor. The more information and detail that can be confirmed in advance, the smoother the process will be once an offer is accepted and processing begins. I would recommend a full pre-approval process whenever it’s possible and time allows."

Another benefit? A pre-approval letter can speed up the closing process since much of the financial vetting has already been completed. This efficiency is especially appealing to sellers looking for a quick transaction.

Pre-Approval Pros and Cons

Pre-approval offers several benefits that can simplify and strengthen your homebuying journey. Knowing exactly how much you can borrow allows you to focus on homes within your budget, eliminating unnecessary guesswork. And in competitive markets, the added credibility with sellers gives you a distinct edge. Additionally, the process can uncover potential financial issues early, saving you time and emotional stress later.

However, pre-approval does require a bit more effort upfront. You’ll need to gather extensive documentation and go through a hard credit inquiry, which can temporarily lower your credit score. Plus, the process can take up to 10 business days – longer than pre-qualification. Despite this, the pre-approval letter provides flexibility by confirming your eligibility for financing while still allowing you to choose your final lender. It’s a small upfront investment for the confidence and competitive edge it brings when you’re ready to make an offer on your dream home.

sbb-itb-8115fc4

Key Differences Between Pre-Qualification and Pre-Approval

Let’s break down the essential differences between pre-qualification and pre-approval, and how they can shape your approach to buying a home. Pre-qualification offers a quick estimate of how much you might borrow based on self-reported data, while pre-approval digs deeper, verifying your finances with documents to give you a stronger position when negotiating.

The core distinction lies in verification. Pre-qualification relies on the financial details you provide, while pre-approval requires official documentation like tax returns and pay stubs, making it a more reliable option in the eyes of sellers.

Victoria Araj, Team Leader for Rocket Mortgage, sums it up perfectly:

"A mortgage prequalification is a quick estimate based on basic financial information provided. On the other hand, a mortgage preapproval is a more in-depth process that involves a credit check and verification of your income, assets, and debts."

Here’s a closer look at how these two options compare and when each might suit your needs.

Side-by-Side Comparison Table

This table highlights the main features of pre-qualification and pre-approval:

| Feature | Pre-Qualification | Pre-Approval |

|---|---|---|

| Mortgage Application | Not required | Required |

| Credit Check | Soft inquiry | Hard inquiry |

| Financial Data | Self-reported | Verified through detailed review |

| Documentation | Not usually required | Includes tax returns, W‑2s, pay stubs, and bank statements |

| Loan Amount | Provides an estimate | Specifies a definitive amount |

| Interest Rate Info | Not provided | Provided |

| Seller Perception | Carries less weight | Carries more weight |

| Reliability | Less reliable, non-binding | More reliable, offering a conditional commitment |

When to Choose Pre-Qualification vs. Pre-Approval

The decision between pre-qualification and pre-approval depends on where you are in your homebuying journey.

- Pre-Qualification: This is ideal if you’re just starting to explore homeownership and need a rough idea of what you can afford. It’s a quick, informal step that works well for first-time buyers or anyone still organizing their finances. Pre-qualification is great for getting an early sense of your borrowing capacity without committing to the full process.

- Pre-Approval: If you’re ready to seriously shop for a home, pre-approval is the way to go. It provides a clear understanding of your financing limits and shows sellers you’re a committed buyer. In competitive markets, this can make a huge difference – 85% of sellers prefer offers from pre-approved buyers [4]. Pre-approval involves a thorough review of your financial situation, so it takes more time, but it can significantly boost your credibility and negotiating power.

While pre-qualification is a quick starting point, pre-approval gives you the confidence and leverage to make strong offers when you’re ready to buy.

How Your Choice Affects the Home Buying Process

Deciding between pre-qualification and pre-approval can significantly influence your home-buying journey. In today’s competitive real estate markets, this choice might determine whether you land your dream home or lose it to another buyer. Let’s take a closer look at how it impacts your negotiating power and timing.

Impact on Negotiations and Trust with Sellers

Walking into negotiations with a pre-approval letter gives you a noticeable edge over other buyers. As Brokers Support Global explains:

"A mortgage pre-approval shows sellers that you are a serious buyer who has already been approved for a loan. Think of it like having a VIP pass to an exclusive event." [6]

This edge can make all the difference when competing against multiple offers.

Pre-approval signals three key things to sellers: you’re serious, financially capable, and ready to close the deal. It shows that you’ve already cleared major financial hurdles, reducing the chances of last-minute issues with your loan. This reassurance can make sellers more inclined to accept your offer.

The advantages don’t stop there. Pre-approval can also strengthen your ability to negotiate. The National Association of Realtors notes that sellers are increasingly open to concessions, such as price reductions, closing cost credits, or flexible move-in dates [7]. Phil Crescenzo Jr., Southeast division president of Nation One Mortgage Corporation, explains:

"A pre-approved buyer is more likely to win an offer over a less prepared buyer or realtor. The more information and detail that can be confirmed in advance, the smoother the process will be once an offer is accepted and processing begins." [1]

While pre-qualification shows you’ve started the process, it doesn’t provide sellers the same confidence that your financing will come through when it’s time to close.

Timing Considerations for Buyers

Timing is just as crucial as negotiation leverage, especially in fast-paced markets where homes can sell within hours.

Having pre-approval in hand speeds up your home search by eliminating the need for last-minute document gathering. This can be a game-changer when you’re ready to make an offer on a property in a competitive market [8].

That said, timing your pre-approval is important. These letters are usually valid for 60–90 days [2] [9]. Applying too early could mean your pre-approval expires before you find the right home, forcing you to go through the process again. On the other hand, waiting too long might cause you to miss out on opportunities when you’re ready to make an offer.

Experts recommend aligning your pre-approval with the start of your active home search. If you’re still in the early stages of exploring options, pre-qualification can give you a general idea of your budget while you organize your finances and research neighborhoods.

Here’s how timing can guide different buyers:

- First-time buyers or those still exploring: Start with pre-qualification to get a sense of your budget, then move to pre-approval when you’re ready to make offers.

- Buyers in competitive markets: Go straight to pre-approval to gain credibility and act quickly in fast-moving situations.

- Buyers with complex finances: Allow extra time for pre-approval, as self-employed individuals or those with unique income sources may need to provide additional documentation.

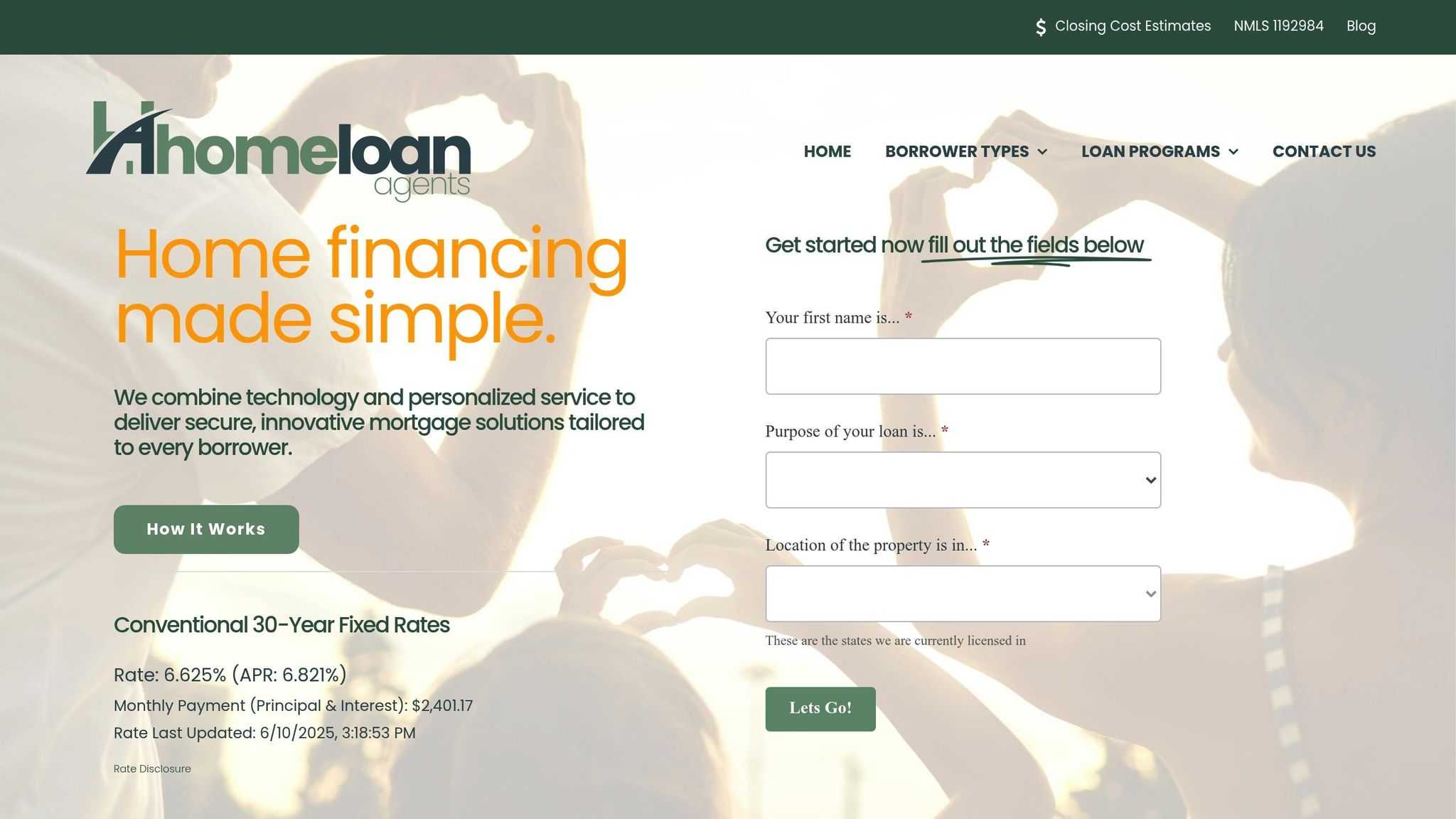

Conclusion: Making Informed Decisions with HomeLoanAgents

Pre-qualification gives you an initial estimate based on the information you provide, while pre-approval takes it a step further by thoroughly reviewing your financial history to confirm your readiness to buy a home [10]. Pre-approval letters are typically valid for 90 days [3], giving you a solid window to make competitive offers with confidence. This distinction not only strengthens your position during negotiations but also simplifies the entire homebuying process.

HomeLoanAgents combines advanced digital tools with meticulous verification to enhance buyer confidence. In fact, 74% of borrowers report that an online approach makes navigating the mortgage process easier than traditional in-person methods [12]. Our technology-driven platform simplifies both pre-qualification and pre-approval by providing real-time updates on your loan status and tailoring mortgage options to fit your financial profile [11]. Whether you’re just starting to explore or are ready to compete in a fast-moving market, our digital solutions offer verified and competitive financing options.

Getting pre-approved not only confirms your financial readiness but also strengthens your negotiating power with sellers. With HomeLoanAgents’ innovative technology and personalized support, you’ll have the tools and expertise needed to secure your dream home. Armed with verified financial backing and a streamlined process, your path to homeownership becomes efficient and rewarding.

FAQs

Why do sellers prefer pre-approval over pre-qualification?

Sellers often favor pre-approval because it proves a buyer is financially prepared to purchase a home. Unlike pre-qualification, which relies on self-reported details, pre-approval requires a thorough examination of your financial situation, including your credit history, income, and assets. This process gives sellers more confidence that you’ll be able to secure the financing needed to close the deal.

Pre-approval also signals a higher level of commitment, which can make your offer stand out – especially in competitive markets. For sellers, this added assurance can be a deciding factor when choosing between multiple buyers.

What documents do I need for mortgage pre-approval?

To get pre-approved for a mortgage in the United States, you’ll need to gather and submit several important documents. Here’s what lenders typically ask for:

- A government-issued ID like a driver’s license or passport

- Your Social Security number

- Recent pay stubs from the last 30 days

- Bank statements covering the past 2–3 months

- Tax returns and W-2s from the previous two years

- Proof of additional income, if applicable (e.g., bonuses, child support, or alimony)

- Business records if you’re self-employed

- Statements for current debts such as auto loans, credit cards, or student loans

In addition, lenders will often pull your credit report (with your consent) and might request extra documents depending on your financial situation. Being prepared with these materials can make the process smoother and bring you closer to owning your dream home.

How long is a mortgage pre-approval valid, and why does it matter for my home search?

A mortgage pre-approval generally remains valid for 30 to 90 days, with the average being around 60 days. This period is crucial as it defines the timeframe for your home search. If your pre-approval expires, you’ll need to go through the application process again, which can slow things down and potentially weaken your position when negotiating with sellers.

A current pre-approval demonstrates to sellers that you’re a committed buyer, giving you an advantage in competitive markets. To avoid setbacks, aim to time your pre-approval with your home search so you’re prepared to make an offer as soon as you find the right property.

Related posts