Want the best loan terms? It starts with how you structure your income. Lenders focus on your income’s stability, predictability, and sustainability, alongside your debt-to-income (DTI) ratio and employment history. Here’s what you need to know:

- Keep your DTI low: Aim for under 36%, with your mortgage payment not exceeding 28% of your income.

- Show steady income: Lenders prefer a consistent two-year work history, even if you’ve changed jobs within the same field.

- Document everything: Pay stubs, tax returns, W-2s, 1099s, and bank statements are critical for proving income reliability.

- Know loan-specific guidelines: Conventional loans allow DTIs up to 50% with strong credit, while FHA, VA, and USDA loans offer more flexibility.

To improve your chances, pay down debt, organize your financial records, and avoid job changes during the loan process. A well-prepared application can help you secure better terms, like lower interest rates and higher borrowing capacity.

Debt-to-Income Ratio Explained (Pt 3 of 6) – Income for Mortgage Qualifying (DTI)

How Lenders Evaluate Your Income

When you apply for a mortgage, lenders take a close look at your financial profile. They don’t just assess the source and type of your income – they also evaluate its stability and how likely it is to continue in the future [2]. This process, which may include ongoing income and employment verification up until the loan is funded [1], plays a vital role in determining your financial readiness for a mortgage.

Debt-to-Income (DTI) Ratio

One of the most important factors lenders consider is your Debt-to-Income (DTI) ratio. A high DTI can result in loan denial or less favorable terms, such as higher interest rates [3].

Lenders typically calculate two types of DTI:

- Front-end ratio: Focuses only on housing-related expenses, including your mortgage payment, property taxes, and insurance.

- Back-end ratio: Includes all your monthly debt obligations, such as credit cards, car loans, student loans, and your proposed mortgage payment [6].

The back-end ratio carries more weight in the decision-making process because it reflects your total debt load [5]. Most lenders prefer a DTI below 35%–36%, but some may accept higher ratios depending on factors like your credit score and cash reserves [4]. Recent data shows that the average DTI for closed mortgages hovers around 40% [5]. If your DTI is too high, you can improve it by paying down current debts, boosting your income, or opting for a more affordable home [3].

Employment History and Steady Income

A steady work history is another key factor in the mortgage approval process. Lenders usually want to see at least two years of consistent employment, as it indicates your ability to make regular payments [7][9]. A longer track record of stable employment strengthens your application even further.

What matters most is stability, not necessarily the job title or employer. If you’ve changed jobs within the same industry or earned promotions, lenders typically view this positively [8]. However, frequent job changes across unrelated fields or gaps in employment might raise concerns about your income reliability [7]. Both your DTI and employment history are evaluated to ensure you have sustainable income levels, which can improve your chances of securing better loan terms [5].

Lenders will verify your current employment and assess whether your income is predictable and likely to continue [7]. They may even contact your employer multiple times during the loan process to confirm that your job status hasn’t changed [1].

Income Requirements by Loan Type

Different loan programs have varying income and DTI guidelines, so it’s important to understand the specifics of each option:

| Loan Type | Maximum DTI | Special Considerations |

|---|---|---|

| Conventional | 43%–50% | Higher ratios allowed with strong credit and reserves |

| FHA | Up to 50% | More lenient with DTI and credit requirements |

| VA | 41% preferred | Additional review for DTIs above 41% |

| USDA | Up to 46% | Requires rural property and income limits |

Conventional loans generally cap DTI at 43%–45%, though some lenders may allow up to 50% if you have excellent credit or substantial cash reserves [6]. FHA loans are known for their flexibility, offering DTI limits as high as 50%, which can be especially helpful for first-time buyers or those with higher debt. However, these loans require mortgage insurance premiums.

VA loans prefer a DTI of 41% or lower, but they don’t have strict caps. Instead, they focus on residual income – what’s left after covering all expenses [5]. USDA loans, designed for rural properties, allow DTIs up to 46% but impose income limits based on regional averages [6].

Knowing these requirements can help you choose the right loan program and prepare your income documentation accordingly. If your DTI is too high for a conventional loan, government-backed options like FHA loans might provide the flexibility you need [3].

Income Types Lenders Accept and Required Documents

When applying for a loan, having the right documentation for your income is crucial. Lenders need to confirm not only that you earn enough to qualify but also that your income is steady and comes from an acceptable source [11]. Whether it’s a standard salary, commissions, self-employment earnings, or even RSU income, most income types can qualify if properly documented [11].

The key here is predictability. Lenders want assurance that your income will continue reliably, so they usually require records covering at least two years of earnings history [10]. Below are the common income types and what you’ll need to provide for each.

W-2 Income and Regular Salaries

W-2 income is the simplest for lenders to verify because it represents consistent and predictable earnings. If you’re employed and earn a salary or hourly wage, you’ll need to provide certain documents to confirm your income [10].

Here’s what lenders typically require:

- Recent pay stubs (usually covering the last 30 days) showing your earnings [14][15].

- W-2 forms from the past one to two years to confirm your annual income and tax withholdings [15][16].

- Verification of Employment (VOE), which may involve your lender contacting your employer directly [13][17].

Because lenders value stability, it’s best to avoid changing jobs while going through the mortgage process [12].

Self-Employment and Business Income

If you’re self-employed, your income can still qualify, but it requires more detailed documentation to establish reliability and trends over time [10].

Here’s what you’ll need:

- Personal and business tax returns for the past two years.

- Profit and loss statements to show your business’s financial health.

- Recent bank statements to verify cash flow [17].

- Balance sheets (if applicable) to provide a snapshot of your business’s assets and liabilities [17].

- Freelancers and independent contractors should also have 1099 forms and current contracts outlining compensation [17][14].

Business owners may want to include additional proof of legitimacy, such as business licenses or insurance documentation [16]. Keep in mind that underwriters will carefully review your income trends, so stable or growing earnings will work in your favor [10]. Also, be cautious about deductions on your tax returns – your taxable income needs to be sufficient to qualify for a mortgage [10].

Variable Income: Commission, Seasonal, and Contract Work

Income that fluctuates, like commissions, bonuses, or seasonal work, can also be used to qualify for a loan, but it requires thorough documentation. Lenders will generally average out at least two years of this type of income to determine how much they’ll count toward your qualifying amount [10].

For commission-based income, you’ll need:

- A history of at least two years of earning commissions [13].

- Verification forms, recent pay stubs, and W-2s from the past two years [13].

- An offer letter detailing your commission or bonus structure [14].

- The last pay stub of the previous year, showing year-to-date additional earnings [14].

- Employer verification of bonuses or commissions earned in the current year [14].

If you’re a contract worker, be prepared to show:

- Your current contract with compensation details.

- Your most recent tax return listing taxable income.

- Recent bank statements to confirm deposits [14].

The better you document your variable income, the more likely lenders are to count it fully toward your qualifying income.

Since income verification can be complex, having your paperwork organized and ready before applying can help streamline the process and avoid delays [17].

sbb-itb-8115fc4

How to Structure Your Income for Better Loan Terms

When applying for a loan, how you structure your income can significantly impact the terms you receive. By presenting your earnings in a way that highlights financial stability and maximizes your borrowing potential, you can improve your chances of securing favorable terms.

Combining W-2 and Self-Employment Income

If you earn both W-2 income and self-employment income, you can use this combination to strengthen your loan application. Lenders evaluate both sources together to determine your borrowing capacity [20].

W-2 income reflects consistent, predictable earnings, while self-employment income demonstrates additional earning potential. However, lenders typically want to see that your self-employment income is stable or growing over time [20]. If your self-employment income is relatively new, pairing it with prior W-2 income can make your application more appealing [20].

To make the most of this approach, ensure you have well-organized records for both income sources. For self-employment, income reported on Form 1099 should be included on Schedule C of your tax return, which may also provide certain tax advantages [21].

Using Tax Returns Without Hurting Your Qualifying Income

Tax returns are a key tool for lenders, especially when assessing income reliability over time. Most lenders review at least two years of tax returns to get a full picture of your financial situation. For self-employed borrowers or those with complex income streams, tax returns can even replace W-2s when applying for a loan [23].

To use tax returns effectively, provide copies that clearly reflect consistent or growing income [23]. Lenders can verify your returns through the IRS Income Verification Express Service (IVES) with your consent via Form 4506-C [22]. Accurate and transparent documentation is essential, especially if you’ve had recent job changes or adjustments to your income.

When to Report Income Changes and Job Transitions

Timing matters when it comes to reporting income changes or switching jobs during the loan process. Ideally, any job changes should occur before you start the mortgage application. Changing jobs during the buying process can complicate things and potentially delay or derail your loan approval [25].

If possible, wait until after closing on your home to make any employment changes [24][26]. However, if a job transition is unavoidable, inform your lender immediately [24]. They’ll need to evaluate your new role, which may include reviewing an offer letter and a recent pay stub. A job change within the same industry is typically less risky for your application [25].

If your loan officer expresses concerns about your job transition, consider holding off on the change until after your loan closes [25]. Should you need to proceed with the change, focus on demonstrating continuity in your field, income stability, and strong long-term prospects in your new position. Open communication with your lender is crucial throughout the underwriting process.

Staying in your current role until after closing can help avoid unnecessary complications [27]. But if circumstances require a change, ensure your lender is fully informed and prepared to verify your new income and employment details [26].

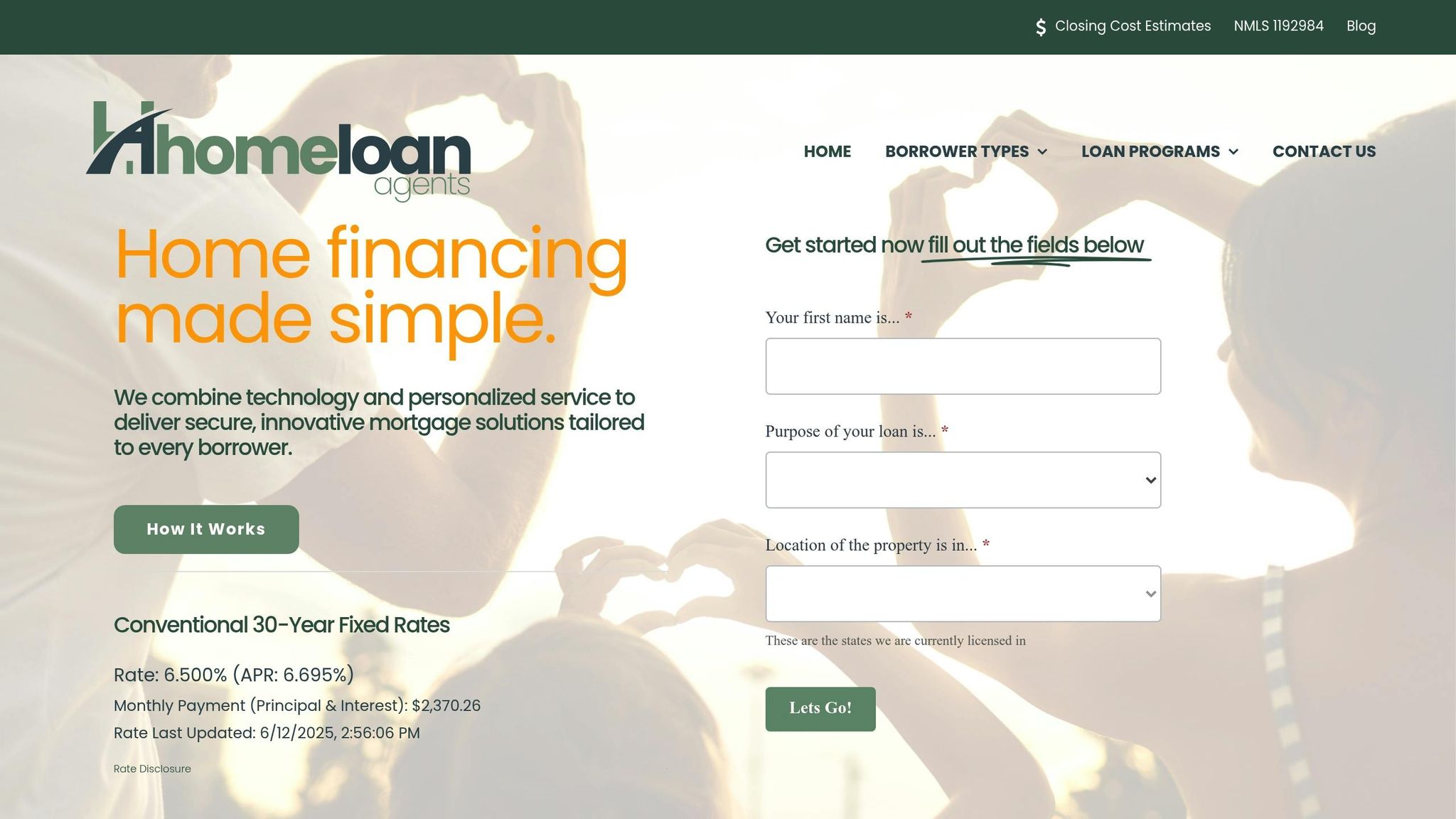

Preparing Your Application with HomeLoanAgents

Once your income is set up to secure favorable loan terms, the next step is to focus on making the application process as smooth as possible. HomeLoanAgents offers a tech-driven platform that simplifies submitting documents and presenting your financial profile.

Gathering and Organizing Your Income Documents

Getting your paperwork in order early can significantly speed up the mortgage process when it’s time to make an offer [1].

Here’s what you’ll need: pay stubs from the last two months for all income sources, tax returns for the past two years (including any 1099 forms if you’re a contractor), and W-2 forms for the same period [19]. If you’re a business owner, include profit and loss statements and business tax returns to show consistent income. Social Security beneficiaries should add their award letter to the mix [19].

Beyond income documents, you’ll need proof of assets. This includes bank statements for checking and savings accounts, as well as paperwork for retirement and investment accounts [19]. Other supporting documents may include a photo ID, divorce papers (if applicable), gift letters for down payment assistance, or proof of rent payments [19].

To stay organized, scan, label, and save all your documents in one secure digital folder [16]. Don’t forget to make copies of everything before submitting them to your lender [16]. Being prepared in this way sets you up to take full advantage of HomeLoanAgents’ advanced digital tools.

Using HomeLoanAgents’ Digital Tools and Expert Help

HomeLoanAgents has modernized the mortgage application process with its secure digital platform. You can submit documents through a secure portal and benefit from automated verification systems [28][29]. The platform even pre-fills much of your required information, saving you time [29]. Uploading files electronically and relying on AI to request any missing documents means you can skip in-person meetings altogether [28][29].

The platform also uses bank data for pre-closing employment and asset verification [30]. These technologies can reduce loan processing time by up to 15 days, which could save you as much as 30% in costs [30].

Benefits of Working with a Technology-Driven Lender

HomeLoanAgents’ digital mortgage tools bring several perks that make the entire process faster and more efficient. Digital applications can be completed up to four times quicker and may cut costs by as much as 40% [32][34]. The AI-powered document processing minimizes errors and ensures compliance, reducing delays caused by documentation issues [32]. Plus, digital asset verification provides real-time access to financial data, which lowers the risk of fraud compared to manual methods [31][34].

"Customers value mortgage application processing speed, which is higher with digital solutions. As a result, you can use this to your advantage and attract more customers to your bank", says Mateusz Wierzbinski, Customer Success Manager [32].

With the average cost of originating a mortgage loan reaching $11,600 in 2023 [34], these digital efficiencies are more important than ever.

"Efficiency gains in that area, from the lender standpoint, can eventually result in a reduction of cost to the industry, and that has a result of a positive, reduced cost to a consumer down the line", explains Kevin Kauffman, Vice President of Client and Partner Delivery at Freddie Mac [30].

HomeLoanAgents’ digital-first approach also aligns with trends in borrower behavior – 92% of homebuyers now use online processes to secure a mortgage [33]. The platform ensures your sensitive financial data stays safe with advanced encryption and secure cloud storage [33].

Key Points for Structuring Income to Get Better Loan Terms

When it comes to securing favorable loan terms, how you present and structure your income can make all the difference. By focusing on stability, lowering your debt-to-income ratio (DTI), and highlighting all qualifying income sources, you can improve your chances of approval and access better rates.

Prioritize income stability. Lenders typically favor borrowers with steady employment and consistent income streams. If your W-2 salary meets the requirements, you might not even need to document self-employment income, which can simplify your application process and save time [38][18].

Don’t overlook other income sources. Beyond your primary job, include any verifiable income such as alimony, child support, disability benefits, VA benefits, or retirement income. These additional streams can increase your preapproval amount and strengthen your financial profile [37].

Tackle your debt-to-income ratio. Paying off existing debts before applying for a loan can significantly improve your DTI ratio. Lower monthly debt payments not only enhance your approval chances but can also lead to better interest rates and higher borrowing capacity [38][37].

Boost your credit score. Your credit score plays a major role in determining your loan terms. A higher score can unlock lower interest rates. To prepare, review your credit report for any inaccuracies and dispute errors. Also, avoid opening new credit lines during the mortgage process, as this can temporarily lower your score [35][38].

Think strategically about your down payment. A 20% down payment doesn’t just eliminate private mortgage insurance (PMI); it can also allow for a larger loan amount, giving you more flexibility [37].

Stay organized with your income documents. Having all necessary paperwork ready to go can prevent delays and help you structure your income effectively.

"Loan officers will use the worst-case scenario", explains John Meyer, a loan expert. "So if you made less in the most recent year, we will use a 12-month average, and if increasing year-over-year, then a 2-year average." [18]

Shop around for lenders. Different lenders have varying criteria and may assess your financial profile differently. This is especially important if you have complex income sources or have recently changed jobs. Combining lender shopping with a stable income and a low DTI can help you secure better terms [37].

With freelancing on the rise – 36% of U.S. workers are now freelancers or independent workers, and projections suggest over half the workforce will join the gig economy by 2027 – effectively presenting diverse income sources is becoming increasingly important [36].

FAQs

What steps can I take to lower my debt-to-income (DTI) ratio and qualify for better loan terms?

Improving your debt-to-income (DTI) ratio can open the door to better loan options. To start, consider ways to boost your income. This might mean asking for a raise, taking on a side hustle, or exploring other income streams. At the same time, work on bringing down your debt. Pay off credit card balances, make extra payments on high-interest loans, or look into consolidating debts under a single, lower-interest loan.

Take a close look at your budget, too. Spot areas where you can trim expenses and use those savings to chip away at your debt. Lenders generally favor a DTI ratio under 43%, so getting as close to – or below – that mark can significantly improve your chances of snagging better loan terms.

What documents do I need to show stable income for a mortgage application?

To show stable income when applying for a mortgage in the U.S., you’ll usually need to submit recent pay stubs, W-2 forms, and tax returns covering the last two to three years. Lenders may also request bank statements and employment verification to confirm your financial situation.

For those who are self-employed or have other income sources, like rental income, additional documentation might be required. This could include profit and loss statements, lease agreements, or expense receipts. Keeping your paperwork clear and well-organized can make the approval process smoother and increase your chances of securing better loan terms.

Will changing jobs during the mortgage process affect my ability to get the best loan terms?

Changing jobs while going through the mortgage process can impact your ability to secure favorable loan terms, but it doesn’t automatically mean disqualification. If your new role is in the same field and your income stays the same or even increases, most lenders will still consider this stable employment. On the other hand, frequent job changes or moving to a completely different industry might raise red flags, potentially delaying your loan approval or altering the terms you’re offered.

To minimize complications, let your lender know about any job changes as soon as possible. They can help you navigate the documentation process and ensure your application stays on track. The key is maintaining stability and providing clear, thorough documentation to keep things running smoothly.

Related posts