Thinking about refinancing your mortgage in 2025? Here’s the short answer: Refinancing can make sense if it saves you money, aligns with your financial goals, or helps you access home equity. However, it’s not always the right move. Use this quick checklist to decide:

- Compare Interest Rates: Current rates are around 6.5%-7%. If your existing rate is higher, refinancing could lower your payments.

- Factor in Costs: Closing costs range from 2%-6% of your loan. Calculate your break-even point to see if the savings outweigh the costs.

- Check Your Financial Situation: A better credit score, higher income, or reduced debt could qualify you for better terms.

- Assess Home Equity: If you’ve built at least 20% equity, you could remove PMI or access cash for major expenses.

- Consider Your Plans: Refinancing may not be worth it if you plan to move soon or already have a low rate.

Pro Tip: Always shop around for the best rates and terms, and make sure refinancing fits your long-term goals.

Should You Refinance Right Now in 2025? Good Move or Huge Mistake?

Pros and Cons of Refinancing

Before deciding to refinance, it’s important to weigh the advantages and disadvantages. While refinancing can provide financial relief or opportunities, it also comes with potential challenges that could affect your long-term financial plans.

Main Benefits of Refinancing

Lower Monthly Payments are one of the biggest reasons homeowners refinance. Even a small rate reduction can lead to noticeable savings. For example, dropping your interest rate by 1% – say, from 7.5% to 6.5% – on a $400,000 loan can save you about $269 per month. A 0.5% decrease could still save around $133 monthly [1].

Access to Home Equity is another appealing benefit, especially as home values have risen. In 2021, home equity made up a median of 45% of U.S. homeowners’ net worth [9]. A cash-out refinance allows you to tap into that equity for things like paying down high-interest debt or funding other financial goals.

"A lot of consumers have increased the amount of debt that they’re carrying outside of their mortgage… A lot of people are just sitting on a mountain of equity, and when you look at it, if you have high-interest credit card debt that you’ve racked up, it may make a lot of sense to utilize that equity to pay off some debt."

Shorter Loan Terms can help you pay off your home faster. Refinancing from a 30-year to a 15-year mortgage not only accelerates equity building but also reduces the total interest paid over time.

"Shortening a mortgage term, like from 30 years to 15 years, can help homeowners save on interest and build equity faster. Conversely, extending the term could reduce monthly payments, offering financial relief."

- Ryan Leahy, a mortgage broker at More Seller Financing [8]

Stable Payment Structure is achievable when switching from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage. This gives you consistent monthly payments, shielding you from future rate hikes and making budgeting easier.

Debt Consolidation is another advantage. Refinancing can combine higher-interest debts – like credit cards or personal loans – into your mortgage, potentially lowering your overall interest costs and simplifying your financial obligations.

Possible Downsides to Consider

While refinancing offers several benefits, it’s essential to understand the potential downsides.

Closing Costs are one of the most significant upfront expenses, typically ranging between 2% and 6% of your loan amount [7]. These costs can add up quickly and should be factored into your decision.

Loan Term Reset is an often-overlooked drawback. Refinancing essentially starts your loan term over, spreading your remaining balance across the new term. If you’ve already paid off several years of your current mortgage, this reset could result in paying more interest overall, even with a lower rate.

Longer Repayment Period can happen if you refinance to lower your monthly payments by extending the loan term. While this provides immediate financial relief, it increases the total interest paid over the life of the loan and delays the day you’ll fully own your home.

Market Timing Risks are another consideration. Interest rates fluctuate, so refinancing at the wrong time could mean locking in a rate that might soon become less favorable.

"If rates drop significantly, it could be a good opportunity for anyone locked into a higher-rate mortgage. But if rates stay flat or even rise, refinancing might only make sense for those who need to tap into home equity or consolidate debt."

- Aaron Cirksena, CEO of MDRN Capital [8]

Qualification Challenges may arise if your financial situation has changed since you took out your original mortgage. A lower credit score, reduced income, or a higher debt-to-income ratio could make it harder to qualify for the best rates – or even to refinance at all.

Opportunity Cost is another factor to think about. The money saved through refinancing needs to be used wisely, whether it’s directed toward retirement savings, paying off other debts, or investing. Without a clear plan, the financial benefit of refinancing could be diluted.

Carefully considering these advantages and disadvantages will help you determine if refinancing aligns with your financial objectives.

Checklist: What to Review Before Refinancing

Refinancing your mortgage can be a smart financial move, but it requires a thorough review of several factors. Here’s a checklist to help you figure out if refinancing makes sense for your situation in 2025.

1. Current Interest Rate vs. Your Existing Rate

Start by comparing your current mortgage rate to today’s averages. As of June 11, 2025, the average interest rate for a 30-year fixed-rate conforming mortgage was 6.874% [11]. Freddie Mac reported a similar average of 6.85% as of June 5, 2025 [10].

If your existing rate is much higher than these averages, refinancing could lower your monthly payments. However, keep in mind that current rates are more than double the record low of 2.65% from January 2021 [4]. Rates in 2025 have hovered around 6.5%, slightly below the 2024 average of 6.7% [4].

Your specific rate depends on your financial profile, including factors like credit score, loan type, and down payment [8]. Even with market averages near 6.8%, borrowers with excellent credit may qualify for better deals. To get a clear picture, request quotes from multiple lenders. Shopping around is essential, as your current lender may not offer the best terms.

2. Changes in Your Financial Situation

Take stock of how your financial circumstances have evolved since you first took out your mortgage.

- Improved credit score: If your credit score has risen, you might qualify for a lower rate. In 2024, 80.3% of new mortgage debt went to borrowers with scores of 720 or higher, while just 3.6% went to those below 620 [12].

- Higher income or lower debt: Promotions, career changes, or paying down debts can improve your debt-to-income ratio, making you a more attractive refinancing candidate.

- Debt reduction: Paying off high-interest debts, like credit cards, before applying for refinancing can strengthen your financial profile [1].

A stronger financial position increases your chances of securing better rates and terms. Once you’ve reviewed your finances, turn your attention to your home’s equity and loan-to-value ratio.

3. Home Equity and Loan-to-Value Ratio

Your home’s equity plays a big role in determining your refinancing options. Lenders typically prefer a loan-to-value (LTV) ratio of 80% or lower, meaning you should have at least 20% equity in your home.

If your home’s value has increased or you’ve paid down a significant portion of your mortgage, your equity may have grown. A better LTV ratio can help you qualify for lower rates and eliminate private mortgage insurance (PMI) if you’re currently paying it.

To assess your equity, you may need a professional appraisal or a comparative market analysis. Appraisal fees typically range from $225 to over $1,000 [14], but this cost is often included in the refinancing process.

If you’re considering a cash-out refinance to access your home’s equity, remember that this will increase your loan balance and monthly payments. Make sure you have a clear plan for how you’ll use the funds and that the additional debt is justified.

4. Costs of Refinancing vs. Expected Savings

Refinancing comes with upfront costs, so it’s essential to weigh those against your potential savings. Closing costs typically range from 2% to 6% of the new loan amount [13][14][15].

Here’s a breakdown of common refinancing costs:

| Cost Component | Typical Range |

|---|---|

| Application Fee | $75 – $500 |

| Credit Check Fee | $25 |

| Home Appraisal | $225 – $1,000+ |

| Title Search & Insurance | $300 – $2,000+ |

| Loan Origination Fee | 0.5% – 1.5% of loan amount |

To determine if refinancing makes sense, calculate your break-even point. Divide your total closing costs by your monthly savings. For instance, if refinancing costs $6,000 and saves you $200 per month, you’ll break even in 30 months.

"Really, it’s about running the numbers and determining if the savings outweigh the costs." – Aaron Cirksena, CEO of MDRN Capital [8]

If you’re planning to move within a few years, refinancing might not be worth it, as you may not have enough time to recover the upfront costs.

Some closing costs, like lender fees, can be negotiated [14]. Compare offers from at least three lenders and push for better terms where possible. If upfront costs are a concern, you might consider a no-closing-cost refinance. Just keep in mind that this option often results in a higher interest rate or rolled-in fees, which could cost more over time [13][14].

Documents Needed and Application Prep

Getting your paperwork in order well in advance can make refinancing smoother and faster. Since the average refinance process takes about 42 days to close, having your documents ready ahead of time not only shows lenders that you’re a serious borrower but also helps keep things moving efficiently. Lenders will need to verify your identity, income, financial standing, and property details, so preparation is key.

"Do this months before attempting a mortgage refinance. And correct any errors you see in your credit report long before applying", – Elizabeth A. Whitman, Attorney [5]

Before you start gathering documents, pull your credit report and fix any inaccuracies. Avoid applying for new credit during this time to protect your credit score.

Document Checklist for Refinancing

Although requirements may vary depending on the lender and your financial situation, most refinancing applications will ask for similar key documents. Here’s what you’ll typically need:

- Personal Identification and Property Documents:

- A valid photo ID

- Your current mortgage statement

- Property deed and property tax statement

- Proof of homeowners insurance

- Flood insurance declaration page (if applicable)

- Income Verification:

- Pay stubs from the past 30 days

- W‑2 forms from the last two years

- Tax returns for the previous two years

- For self-employed individuals: 1099 forms and profit-and-loss statements

- Non-Employment Income:

- Social Security income: SSA‑1099, award letter, or bank statements showing deposits

- Pension income: 1099‑P or other proof of income

- Alimony, child support, or disability payments: documents verifying both the amount and duration

- Investment income: forms like 1099‑INT (interest), 1099‑DIV (dividends), or 1099‑B (capital gains)

- Asset Verification:

- Statements for bank accounts, investments, and retirement accounts

- Brokerage statements for individual stock holdings (showing stock names, share prices, and quantities)

- Documentation for any additional real estate or significant assets

- Debt Information:

- Statements for auto loans, credit cards, student loans, and installment loans

- Documentation for home equity loans or lines of credit

- A list of creditors with monthly payment amounts and remaining balances

- Additional Documentation:

- Divorce decree (if alimony or child support applies)

- Gift letters for large deposits to confirm they’re not loans

- Inspection reports for properties with septic systems or wells

- Subordination letter if you’re keeping an existing home equity line of credit

- Employment History:

- A record of your employment over the past two years, including employer names and addresses

- Letters of explanation for employment gaps or issues on your credit report

Start organizing these documents early, either digitally or in physical files, so you can respond to lender requests quickly. Being prepared not only speeds up the process but also shows lenders that you’re reliable and well-organized. With everything ready, you’ll be in a strong position to move forward with refinancing. Stay tuned for tips on evaluating the best timing for your refinance in the next section.

sbb-itb-8115fc4

When to Refinance vs. When to Wait

With 2025 mortgage rates hovering around 6.5% and predictions indicating they might stay between 6.5% and 6.9% by the end of the year, timing your refinancing decision can make a significant financial impact. Knowing when to act – or when to hold off – can save you money or prevent unnecessary expenses [4].

Good Times to Refinance

Certain situations make refinancing a smart move. Here are some of the key scenarios:

- Interest Rate Drops: If your current mortgage rate is higher than what’s available, even a modest decrease can lower your monthly payments and save you money over time. This is especially true if you locked in a higher rate in the past.

- Improved Credit Score: A better credit score could qualify you for more favorable rates, which means smaller monthly payments [17].

- Eliminating Private Mortgage Insurance (PMI): If you’ve built up 20% equity in your home, refinancing can help you remove PMI, cutting down your monthly expenses.

- Switching from an ARM to a Fixed-Rate Loan: Adjustable-rate mortgages (ARMs) can be unpredictable. With rates expected to remain in the high-6% range, moving to a fixed-rate loan provides stability and shields you from potential rate hikes [2].

- Cash-Out Refinancing for Major Expenses: Refinancing to access your home’s equity can be a strategic move for funding home renovations, consolidating debt, or paying for education – especially if the new interest rate is lower than what you’re paying on other debts [18].

- Adjusting Payments Due to Life Changes: Major events like a divorce or job change might require more flexibility in your loan terms. Refinancing can help by adjusting the length of your loan to better suit your new circumstances [18].

Times When Refinancing May Not Make Sense

While refinancing can be beneficial in many cases, there are scenarios where it might not be the best choice:

- Short Remaining Loan Terms: If you’re nearing the end of your mortgage – say, fewer than 10 years – refinancing to a longer-term loan could increase your total interest payments, even if your monthly payments go down.

- Plans to Move Soon: According to Ryan Leahy, Mortgage Broker at More Seller Financing:

"If someone intends to sell within a few years, refinancing may not provide enough time to recoup those costs." [8]

With closing costs typically between 2% and 6% of the loan amount [16], you’ll need to stay in your home long enough to break even.

- High Closing Costs vs. Savings: Tom Furey, co-founder of Neat Capital, advises:

"Determining whether the total costs to refinance make sense heavily depends on how long you plan to keep the loan." [1]

If the savings from refinancing are small compared to the upfront costs, it might not be worth it.

- Already Low Fixed Rates: If you secured a mortgage in 2020 or 2021 when rates were historically low, refinancing at today’s rates likely won’t save you money.

- No Credit Score Improvement: If your credit score hasn’t improved since you got your original mortgage, you may not qualify for better rates, limiting the benefits of refinancing.

- Shorter Terms That Strain Your Budget: Refinancing to a 15-year mortgage can save you on long-term interest, but the higher monthly payments might stretch your budget too thin [16].

Aaron Cirksena, CEO of MDRN Capital, sums it up well:

"Really, it’s about running the numbers and determining if the savings outweigh the costs." [8]

Take the time to calculate your break-even point – how long it will take for your monthly savings to cover the closing costs – and make sure this aligns with your homeownership plans. A clear understanding of these factors will help you make the best decision for your financial future.

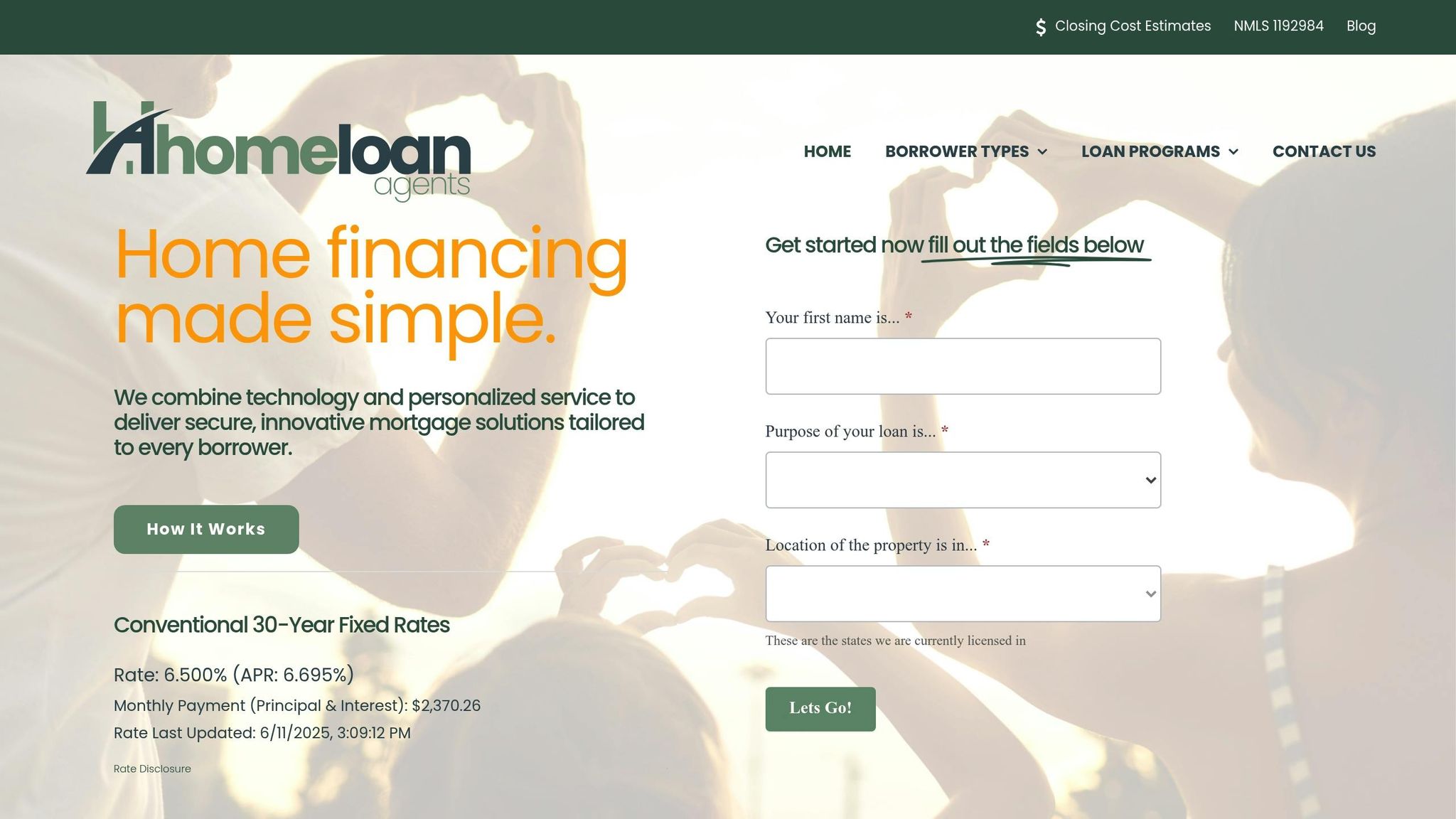

How HomeLoanAgents Can Help Simplify Your Refinancing Journey

Refinancing can feel overwhelming, but HomeLoanAgents makes it easier with a digital-first approach and personalized loan solutions for all types of borrowers – whether you’re a W-2 employee, self-employed, or a real estate investor. Here’s how their tailored options and streamlined technology put you in control.

Custom Loan Options and Expert Guidance

Every borrower has different goals, and HomeLoanAgents recognizes that. Whether you’re aiming to reduce your monthly payments, need flexible qualification terms, or want to explore cash-out refinancing, they offer a variety of loan programs designed to fit your needs.

For veterans and active military members, HomeLoanAgents provides competitive VA loan refinancing options, which require no down payment. If you’re looking for short-term rate flexibility, their Adjustable-Rate Mortgage (ARM) refinancing offers lower initial interest rates, making it a smart choice if you plan to move or refinance again in a few years.

Real estate investors can benefit from DSCR (Debt Service Coverage Ratio) loans, which focus on the income generated by the property rather than personal income verification. This is particularly useful for those managing multiple properties or complex financial situations.

HomeLoanAgents’ loan advisors take the time to understand your goals and recommend refinancing strategies that align with your needs. Whether it’s transitioning from an ARM to a fixed-rate loan for more stability or tapping into your home equity for significant expenses, they guide you every step of the way.

Digital Application Process

HomeLoanAgents doesn’t just stop at offering tailored loan options – they also simplify the entire refinancing experience with their digital platform. Refinancing traditionally involves mountains of paperwork and lengthy timelines, but HomeLoanAgents streamlines this with cutting-edge technology.

Their platform provides real-time loan updates, so you know exactly where your application stands. Using AI and machine learning, they evaluate your financial profile beyond just credit scores, which can be especially advantageous if your financial situation has improved since your original mortgage.

Sensitive documents can be uploaded securely through an encrypted, auto-organizing system, eliminating the need for faxing or mailing paperwork. Plus, the digital process can shave about 14 days off the typical refinancing timeline compared to traditional methods [20]. This speed is a game-changer, especially when interest rates are fluctuating.

HomeLoanAgents also offers eClosing capabilities, allowing much of the closing process to be completed electronically. This not only saves time but also simplifies the final steps of refinancing.

Their platform provides clear insights into loan options, rates, and terms, ensuring transparency throughout the process [19]. You can compare scenarios, calculate potential savings, and see how closing costs impact your break-even timeline – all before making a commitment.

Conclusion: Making Your Refinancing Decision

When considering refinancing in 2025, take the time to crunch the numbers and evaluate your financial situation. The checklist we’ve discussed offers a solid framework to guide your decision-making. It includes comparing current rates with your existing mortgage, calculating your break-even point, checking your credit score and home equity, and weighing the total costs against potential savings.

Refinancing should align with your long-term financial goals. Whether you’re looking to lower monthly payments, access your home equity, or switch from an adjustable-rate to a fixed-rate loan for added stability, ensure the new mortgage fits your broader financial plans. For instance, today’s rates – 7.02% for a 30-year loan and 6.27% for a 15-year loan [3] – can help you assess whether refinancing makes sense. Don’t forget to factor in closing costs, which typically range from 3% to 6% of your loan balance [6], to calculate your break-even point.

If your analysis shows refinancing is the right move, consider using HomeLoanAgents’ digital platform. They offer expert guidance, competitive rates, and a streamlined process tailored to your needs – whether you’re a W-2 employee, self-employed, or a real estate investor. There’s no need to navigate the process alone when professional support is readily available.

Review your checklist, gather your documents, and request personalized quotes. With thoughtful preparation and the right resources, you can make a well-informed refinancing decision that strengthens your financial future.

FAQs

How can I decide if refinancing my mortgage in 2025 is the right move for me?

Deciding whether to refinance your mortgage in 2025 comes down to a few important considerations. Start by taking a close look at your financial health. This includes checking your credit score, debt-to-income ratio, and how much equity you’ve built up in your home. These factors will directly influence the refinancing options available to you and the interest rates lenders may offer.

You’ll also want to weigh the costs of refinancing against the potential benefits. Refinancing often comes with expenses like closing costs and, in some cases, prepayment penalties. Compare these costs to what you stand to gain – whether that’s lower monthly payments, a reduced interest rate, or even a shorter loan term. Your goals matter here: Are you aiming to save money over time, reduce your monthly financial burden, or tap into your home equity for cash?

Lastly, think about how long you plan to stay in your home. If you’re not planning to stay long enough to offset the upfront costs of refinancing, it might not be the right move. Carefully assessing these factors will help you figure out if refinancing aligns with your bigger financial picture.

What should I think about when choosing between a fixed-rate and adjustable-rate mortgage for refinancing?

When choosing between a fixed-rate mortgage and an adjustable-rate mortgage (ARM) for refinancing, start by thinking about your financial goals and how long you plan to stay in your home. Fixed-rate mortgages offer steady monthly payments throughout the life of the loan. This consistency makes them a solid option if you prioritize stability or expect to stay in your home for many years. On the other hand, ARMs generally come with lower initial interest rates, which can save you money upfront – ideal if you plan to move or refinance again before the rate adjusts.

It’s also important to factor in current and future interest rate trends. If rates seem likely to rise, locking in a fixed rate could be a safer bet. But if rates are stable or expected to drop, an ARM might save you more in the short term. The best choice ultimately depends on your financial situation, how comfortable you are with risk, and how long you intend to keep the loan.

How do I figure out the break-even point for refinancing, and why does it matter?

To figure out your refinancing break-even point, start by adding up all the costs involved – this includes closing costs, fees, and any other expenses tied to the refinance. Next, calculate how much you’ll save each month by subtracting your new mortgage payment from your current one. Finally, divide the total refinancing costs by your monthly savings. For instance, if your refinancing costs total $5,000 and your monthly savings are $200, your break-even point would be 25 months ($5,000 ÷ $200).

Knowing your break-even point is key because it shows how long it will take to recover the upfront costs of refinancing. If you’re planning to sell your home or move before hitting that point, refinancing might not make financial sense. This quick calculation can help you see if refinancing fits with your long-term goals.

Related posts