Housing Market Outlook for 2025:

Expect moderate price growth of 3.7%, a 13.8% rise in single-family home construction, and a drop in mortgage rates from 6.2% to 5.6% by year-end. Inventory is projected to grow by 11.7%, while sales are set to increase by 1.5%, reaching 4.07 million homes sold.

Key Highlights:

- Home Prices: Predicted to rise between 1.6% and 3.5%.

- Mortgage Rates: Expected to fall to around 5.6% by December.

- Housing Supply: Inventory up 11.7%, with 642,000 homes available (vs. 507,000 last year).

- Buyer Activity: Regional trends vary; Texas shows a 4.8-month supply, and California anticipates a 10.5% sales increase.

These trends, influenced by Federal Reserve policies and regional shifts, will shape buying, selling, and renting decisions.

2025 Mortgage Rate & Housing Market Forecast – 3/25/25 …

4 Main Housing Market Indicators for 2025

Let’s take a closer look at four key factors – home prices, interest rates, housing supply, and buyer activity – that are shaping the housing market in 2025.

Home Price Trends

Experts predict home prices will grow by 1.6% to 3.5% in 2025, suggesting a steady market ahead [1].

Interest Rates and Affordability

Mortgage rates are expected to drop to around 6.7% by the end of 2025. This slight decrease could make monthly payments more manageable and encourage more buyers to enter the market [1].

Housing Supply Updates

The number of available homes has climbed to 642,000, compared to 507,000 the previous year. Weekly new listings even hit a three-year high of 64,000 [2]. In the greater Philadelphia area, active listings have increased by 16.7% year-over-year, reaching 30,575 [2].

Buyer Activity and Regional Differences

Buyer behavior in 2025 reflects the interaction between higher inventory levels and shifting interest rates. Regional data highlights these differences – Texas, for instance, has a 4.8-month supply of homes. Keeping an eye on these trends can help identify opportunities in the market [1].

Using Market Data for Better Decisions

Use four main indicators – prices, rates, supply, and demand – to guide your decisions. Then, monitor three key signals to transform data into actionable insights.

Reading Housing Reports

Pay attention to price indices, rate trends, and inventory levels. Comparing monthly and yearly changes can help you identify patterns and shifts in the market.

Market Signals to Watch

These metrics connect to the four main indicators and reveal real-time market changes:

- Weekly mortgage-rate changes: Reflects shifts in affordability

- Monthly active listings: Indicates the balance between supply and demand

- Purchase applications: Shows how buyer interest is evolving

Buy, Sell, or Rent Decision Guide

Here’s how to decide your next move:

- If rates drop below what you can afford, buying might be the best option [3].

- If purchase applications decline while listings increase, renting or waiting could make more sense [4].

sbb-itb-8115fc4

Local Markets and Housing Rules

Regional differences and updated regulations are shaping how national trends in prices, rates, supply, and demand play out in specific areas.

State-by-State Market Differences

California REALTORS® predict a 10.5% increase in home sales and a 4.6% rise in median prices for 2025. While Los Angeles and San Diego show moderate growth, the Bay Area could see slight declines due to affordability challenges [5].

Meanwhile, migration into Arizona, Nevada, and Oregon is driving demand in markets with lower housing costs [5].

These variations highlight how local trends can differ significantly from national averages.

New Housing Laws and Rules

Changes in zoning regulations and new incentives are speeding up construction in suburban areas and smaller markets [5].

At the same time, buyers are placing more importance on energy efficiency, spurred by recent sustainability programs [5].

To keep up with these changes, it’s important to focus on key local metrics.

Finding Your Local Market Data

To make national housing forecasts more relevant to your area, keep an eye on these three key metrics:

- Local price indices

- Monthly sales volume

- Average mortgage rates

You can find this information through regional REALTOR® associations, building permit records, and neighborhood sales data. Also, pay attention to remote-work trends, as they can signal increased demand in suburban and smaller metro areas [5].

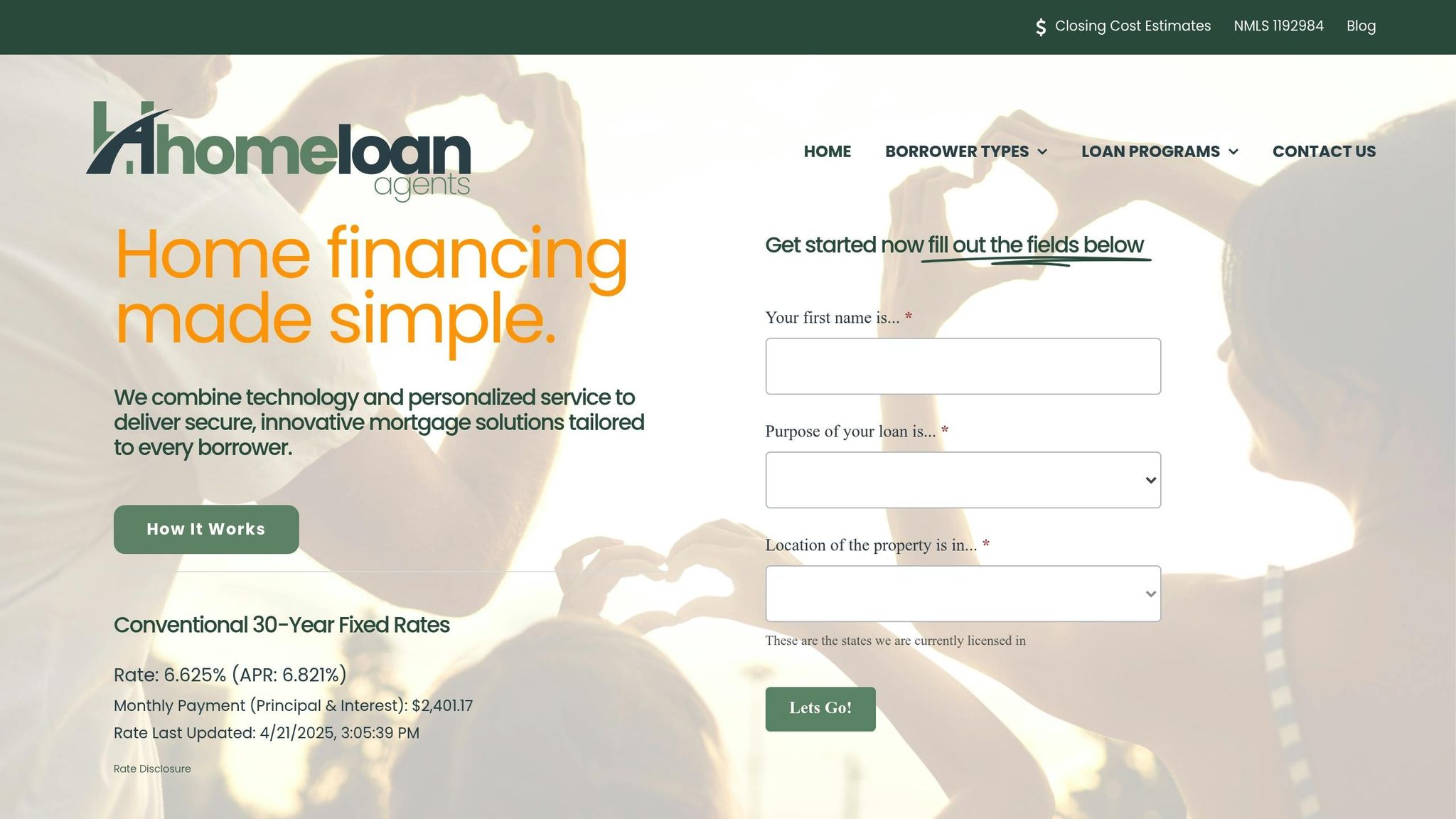

HomeLoanAgents Mortgage Services

Leverage local knowledge to find financing that aligns with 2025 market trends.

Custom Loan Programs

Explore a variety of loan options designed to meet your needs:

- Fixed-rate mortgages for consistent monthly payments

- FHA loans with more flexible credit requirements

- VA loans for qualified service members and veterans

- DSCR loans tailored for real estate investors

- Jumbo and Non-QM loans for specific financial scenarios

Our platform uses market insights to help you find the best loan for your situation.

Digital Mortgage Tools

Streamline the mortgage process with cutting-edge tools:

- Digital income verification to simplify and speed up approvals

- eClosing platform for completing closings remotely

- Real-time updates to track every stage of your loan process

Personalized Mortgage Support

Work with experienced professionals to:

- Assess local market trends and make informed decisions about buying or refinancing

- Secure pre-approval to strengthen your offer in a competitive market

- Explore tailored programs that align with your financial goals and future plans

Conclusion

In 2025, expect moderate price growth (3.7% according to Realtor.com), a 13.8% increase in single-family home construction, and slightly lower mortgage rates (dropping from 6.2% to 5.9%). Keep an eye on home prices, mortgage rates, inventory levels, and buyer demand to pinpoint the best times to buy or refinance. Focus on the four main indicators – prices, rates, supply, and demand – to make well-informed decisions.

Related posts